Is There a Shortage Disaster Looming? – June 7, 2021

This is an excerpt from our most recent Financial Outlook report. To obtain the complete PDF, be sure to click on below.

As any youthful entrepreneur that ever ran a lemonade stand will be ready to affirm: possessing a line of consumers around the block, but no stock, is negative for enterprise. As the U.S. financial system is commencing to recover briskly and sees individuals coming again out to enjoy all over again (to stick to the topic of our preceding analogy), producers of goods are ever more acquiring themselves in a comparable condition.

Shortages for various solutions (it wasn’t just toilet paper) appeared frequent throughout the pandemic very last calendar year, due to the lockdown of the U.S. financial system. The gradual reopening of the U.S. economic system has been accompanied by a continuation of the shortages across the board, much too. Whilst commodities are primary the charge, the most up-to-date shortage is extra common, and subsequently has an effect on final buyer goods throughout the board.

Even though people have come to conditions with the actuality that orders may well choose for a longer time than normal, traders are remaining wanting to know what the implication of this could be for the restoration method. Are we just spinning our wheels for a though and will get back again to business enterprise as regular soon? Or is this the sign of an overheating economic climate that will conclusion up getting straightened out by our mom and dad the Fed? (That was the very last of the childhood analogies).

An outdated indicating between economists describes supply shortages as a challenge solved quickly: “If the line is much too very long, the selling price is much too very low.” Nonetheless, a substantial U.S. sized economic climate, continuing to operate incredibly hot for extended intervals of time, may well uncover itself introduced with raising inflationary pressures. That may possibly pressure the Fed’s hand and set off a coverage response. And that may possibly shut off the restoration in its still very early stages.

On the other hand (Harry Truman’s wish for a a person-handed economist may well by no means appear true, it appears to be), if we locate the bottlenecks in provide turn into much less commonplace and individuals locate their demand is met, this enhancement could possibly establish to be temporary. So, the latest inflationary pressures might be in fact transitory. When it comes to the diploma to which the shortages are a systematic trouble — or of a small-term nature — it is critical to distinguish the underlying explanations.

(1) A variety of currently seasoned shortages can be traced again to the effects of one-off idiosyncratic market source occasions (such as significantly cold February this calendar year) that paralyzed the U.S. petrochemical field together the U.S. Gulf Coastline. That caused ripple outcomes down the supply chain now. But these will inevitably fade, in conditions of its influence on the international overall economy.

Similarly, several disruptions along the transportation chain, these as the Suez Canal blockage, or the shortage in shipping containers brought on and however proceed to bring about disruptions together transportation networks that ultimately are indistinguishable from true offer shortages. These will also show to be short term.

(2) Equally of a temporary nature will be the basic point: Our complete financial system went from comprehensive shutdown to functioning on all cylinders (or shut to) within a small time period of time. Firms basically have to go through adjustment processes. Feel of this in conditions of rehiring employees that may possibly have been enable go, and finding nearer to creating at total capability.

(3) Issue in just one-off outcomes from an unparalleled movement of U.S. stimulus checks. They did aid those who needed aid the most.

A new investigation of Census Bureau data located: Experiences of foods shortages fell -42%, a -43% decrease in a gauge of economic instability was viewed, and “repeated stress and anxiety and melancholy” fell about -20%. $325B in cheques went out in March thanks to the American Restoration Act, versus $61B in April. There was a reasonably trivial residual sum sent through May perhaps.

(4) A significantly less-essential surge in pent up demand from customers may well be one more momentary offender. Currently being locked up at dwelling for in excess of a calendar year, individuals have begun to perform on their extended “to-do” lists of fixes all-around the residence. These, with hindsight, look to be the apparent factor that was intended to take place.

But during the pandemic, such client exercise was very probably difficult to forecast, especially for producers who require to cautiously harmony their balance sheet wellbeing with inserting orders for input components for a opportunity surge in demand for their products. We assume that this will also confirm to be of non permanent mother nature. You can only fix so a lot about your household (some of our spouses could disagree).

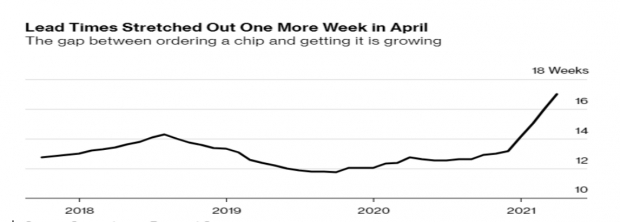

(5) Different from this laundry listing of aspects, the lack in semiconductors could possibly prove to be the one particular with the longest impact. Though there is a broad assortment of factors for the scarcity, a person of the drivers of the shortage will be to some degree relentless all through the upcoming handful of several years.

Namely, demand from customers. That is, with the improved reliance of our modern society on sophisticated know-how in the course of the pandemic (in the varieties of online video meetings, cloud computing and many others.) the line of products that rely on these products and solutions is only getting for a longer period.

It is our expectation the chip source-side will gain most from this enhancement. In distinct, desire for back again-stop semiconductor wafer fabrication aid from the likes of Zacks #1 Ranked ASML and Lam Study. Ditto ‘new generation’ chip suppliers like Zacks #1 Ranked State-of-the-art Micro Equipment and Nvidia.

This component of the U.S. financial state probably has to go as a result of a possibly lengthy adjustment course of action, to be capable to serve enhanced demand from customers. Confirm that in the chart proven below.

Impression Supply: Susquehana Money Group

Impression Supply: Susquehana Money Group

(6) In the end, it is, having said that, our expectation the amalgamation of all these elements, whilst regrettable, will confirm to be short term in character. This exceptional combination of latest situations won’t be the result in for a significant disruption of the U.S. recovery system.

Infrastructure Stock Growth to Sweep The united states

A enormous push to rebuild the crumbling U.S. infrastructure will soon be underway. It is bipartisan, urgent, and inescapable. Trillions will be spent. Fortunes will be designed.

The only query is “Will you get into the appropriate stocks early when their advancement probable is biggest?”

Zacks has produced a Exclusi

ve Report to support you do just that, and right now it’s absolutely free. Explore 7 special corporations that glance to achieve the most from development and fix to roads, bridges, and buildings, moreover cargo hauling and vitality transformation on an virtually unimaginable scale.

Download Totally free: How to Profit from Trillions on Investing for Infrastructure >>