Keppel Corp Vs Sembcorp Marine

[ad_1]

It’s been a wild ride for offshore and marine companies this year.

Oil prices have spiked above US$130 per barrel earlier this month as traders feared an embargo on Russian oil exports due to the ongoing Russia-Ukraine war.

Prices have since come down to around US$100 per barrel.

Two companies on the Singapore stock market have significant exposure to the oil and gas industry — blue-chip conglomerate Keppel Corporation Limited (SGX: BN4) and Sembcorp Marine Ltd (SGX: S51), or SMM.

We decided to compare the two offshore and marine giants to determine which makes the better investment.

Financials

In terms of financial performance, Keppel stands out as it registered a 31.2% year on year increase in revenue to S$8.6 billion.

The conglomerate reported improved revenue across all its four divisions and also saw a strong surge in operating profit.

The increase in operating profit was due to lower credit losses on contract assets and higher fair value gains on investments.

Keppel Corporation turned around with a net profit of S$1 billion, reversing the net loss of S$505.9 million a year ago.

It was the group’s highest net profit in six years.

SMM managed to grow its revenue by 23.3% year on year to S$1.9 billion but incurred an operating and net loss.

Winner: Keppel Corp

Debt indicators

Next, let’s look at the debt profile for both companies.

Keppel Corp held cash and investments of S$3.6 billion but also had total debt of S$11.4 billion, resulting in net debt of S$7.8 billion.

However, investors should note that Keppel also has a real estate division that engages in development projects.

Hence, the debt load is used to support more than just the offshore and marine division.

Moreover, the group holds around S$4.3 billion of investment properties that are used as collateral for the debt.

SMM has a lower cash balance of S$1.1 billion but also less debt than Keppel Corp, and its net debt to equity and total assets are also lower than its peer.

Winner: Sembcorp Marine

Cash flow

Moving on to cash flow, both businesses generated negative operating cash flow for fiscal 2021 (FY2021).

However, Keppel Corp did manage to generate positive operating cash flow in FY2020 of S$202.4 million while SMM’s operating cash flow was negative for both fiscal years.

Although capital expenditure for Keppel Corp appears much higher than SMM, part of this expenditure included purchases of investment properties for its Keppel Land division.

Winner: Keppel Corp

Order book

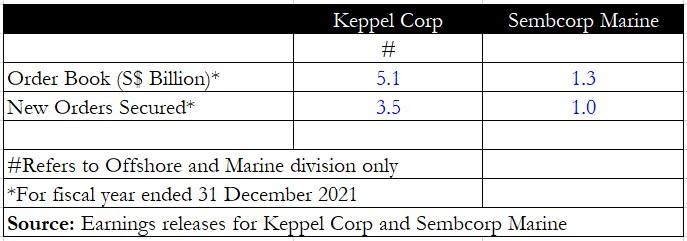

Keppel Corp has one up on its order book at S$5.1 billion versus SMM’s S$1.3 billion.

The new orders secured during FY2021 also came up to S$3.5 billion for Keppel Corp, more than three times the orders that SMM secured.

Around S$4 out of every S$10 of its order book comprises renewables and gas solutions, showcasing its steady pivot away from fossil fuels.

For SMM, around 43%, or S$559 million, of its order book consists of renewables, clean and green energy solutions.

Winner: Keppel Corp

Dividends

When it comes to dividends, there’s no contest here as SMM has halted the payment of dividends due to continued losses.

Keppel Corp, on the other hand, has more than tripled its FY2021 dividend to S$0.33 from S$0.10 a year ago.

Keppel Corp shares offer a 5.1% trailing dividend yield based on its last traded price.

Winner: Keppel Corp

Get Smart: Conglomerate structure offers a buffer

Keppel Corp emerged as the winner as it not only posted a strong net profit but also reported a robust order book and more than tripled its total dividends.

SMM, on the other hand, had to tap on the capital markets twice within a year to shore up its balance sheet as it faced difficulties in delivering its projects due to COVID-19 restrictions and foreign worker shortages.

Keppel Corp’s conglomerate structure helped to buffer it from the worst of the pandemic’s effects as its real estate and asset management divisions remained resilient.

With oil prices seeing a sustained rise, both companies may stand to benefit in the year ahead.

Is it a good time to buy into Singapore REITs? If you’ve thought about it, then our latest REITs guide will be an essential read. This exclusive pdf report shows you why REITs are still excellent assets, what sectors to look out for and how to find good REITs today. The info inside can help you build a solid retirement portfolio. Click here to download it for FREE.

Follow us on Facebook and Telegram for the latest investing news and analyses!

Disclaimer: Royston Yang does not own shares in any of the companies mentioned.

The post Better Buy: Keppel Corp Vs Sembcorp Marine appeared first on The Smart Investor.

[ad_2]

Source link