Leasing a car vs. buying a car — how to decide

[ad_1]

Hello and welcome to Fiscal Facial area-off, a MarketWatch column exactly where we support you weigh monetary choices. Our columnist will give her verdict, then you can tell us in the opinions what you feel.

When you purchase a car or truck, you normally pay back 20% income up-entrance, then fork out off the stability in monthly payments (with interest, of training course). With leasing, you may well have to make a down payment depending on your credit score, and you then make monthly payments for the length of the lease, normally two to three many years.

Leasing vs. getting is a classic economical preference, but the COVID-19 pandemic has brought with it new and unconventional wrinkles. It is an incredibly hard time to acquire a car or truck. Stock is lower thanks to the world wide microchip scarcity, and charges on equally new and made use of products are at record highs.

The common new-automobile transaction cost was $47,077 as of January 2022, up from an ordinary of $43,332 in 2021. The ordinary value for a utilized automobile in 2021 was $26,910, up from $22,337 in 2020.

“‘New car costs are through the roof, utilised car or truck selling prices are through the roof.’”

Translation: Like some homes, autos are now advertising for earlier mentioned the asking rate.

“I’ve been performing this for well in excess of a decade and I’ve in no way seen what we’re encountering. New automobile selling prices are through the roof, made use of automobile charges are by the roof,” mentioned Kelley Blue E-book editor Matt Degen.

Costs are so superior that some authorities say it is finest to hold out as lengthy as you can in advance of getting a new auto.

But if your previous clunker just quit, or your new job means you want to generate additional, here’s how to decide whether to lease or buy, according to vehicle-obtaining professionals from Kelley Blue Ebook and Edmunds.com and far more than a dozen economic advisers with the National Association of Individual Money Advisors.

Why it issues

Brace your self for sticker shock. The normal regular bank loan payment on a new motor vehicle hit a record substantial of $636 in the 3rd quarter of 2021, according to the credit rating reporting corporation Experian

EXPN,

and the regular every month lease payment was $506.

America’s most common vehicle, the Ford

F,

F-150 pickup, had an regular regular lease payment of $542 or an average month-to-month financial loan payment of $768 in Q3 2021, Experian uncovered.

That makes it seem like leasing is more cost-effective — and it is, if you only seem at the month-to-month payment. But if you obtain a car and keep on to it very long plenty of to shell out off the financial loan, getting will price you considerably less than leasing in the extended operate.

“It is the least expensive in excess of the everyday living of the motor vehicle, in particular if you’re going to have it for seven to 10 yrs. The math is likely to enjoy out in your favor and it will be cheaper than leasing around and above again,” mentioned Ivan Drury, senior supervisor of insights at Edmunds.com.

The verdict

Invest in. Indeed, even at these selling prices.

My motives

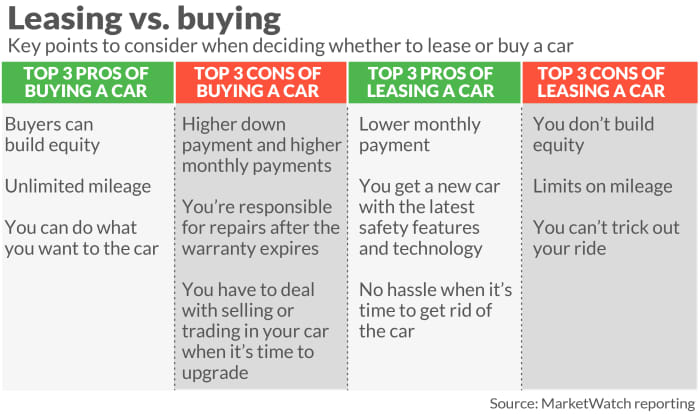

Prospective buyers can develop equity. Immediately after you fork out off your financial loan, you have the automobile cost-free and clear and it turns into an asset that you can possibly market or use to defray the cost of your upcoming auto, claimed Degen, who paid out all funds for his individual individual car, which is now 20 several years previous.

Purchasing is far better for anyone who would like flexibility with yearly mileage and intends to keep the car or truck for longer than the time period of the automobile bank loan, reported Scott Buttfield, a certified economical planner with Buttfield & Associates in Crimson Bank, New Jersey.

“The remedy to this query is the universal solution to most fiscal organizing concerns: it depends,” Buttfield stated.

Leasing is great for individuals who won’t put far more miles on the auto each and every yr than the cap lets (see underneath), want a decreased month-to-month payment, want a new auto on a regular basis, and in basic choose great care of a auto, Buttfield extra, simply because leases require that automobiles be returned in excellent situation.

For someone who’s likely to personal a automobile for additional than six yrs, obtaining is the improved selection. But if you will need a new motor vehicle each and every two or 3 several years, leasing is superior.

Revenue is reasonably low-cost to borrow right now for persons with excellent credit rating, which can make purchasing extra desirable. If you have bad credit score, nevertheless, it can negatively affect what variety of lease offer you can get, such as the measurement of your down payment and monthly payments.

Is my verdict best for you?

“The math is very simple: proudly owning a motor vehicle for the extensive time period and holding up with the maintenance approach is much less expensive than leasing. The real challenge is, ‘What variety of vehicle person am I?’” says Josh Chamberlain, a qualified financial planner with Chamberlain Financial Advisors in Decatur, Ga.

Most importantly, how substantially do you push in a year? This is crucial simply because leases have boundaries on the quantity of miles you’re allowed to put on a automobile each individual 12 months (commonly all over 10,000 to 15,000 miles). If you go above that, you have to fork out a penalty for each mile. All those can truly include up.

“‘If you have dedication difficulties in any component of your life, leasing is excellent for you.’”

Are you the form of car or truck proprietor who likes to personalize your automobile with huge rims and a kickin’ speaker method? Leasing is not a very good solution for you, simply because you can not make alterations to leased motor vehicles.

Other key questions: How important is it for you to have a decrease month-to-month payment? Leasing gives that. How critical is it to you to generate a awesome, new car? Leasing is a way to get an entry-amount luxurious vehicle for a somewhat reduced monthly price tag. And you get to improve every single number of yrs.

“If you have dedication challenges in any aspect of your lifestyle, leasing is excellent for you,” Drury said.

Is my verdict most effective for you? Tell us in the feedback which selection ought to earn in this Monetary Experience-off. If you have thoughts for future Economic Experience-off columns, deliver me an email.

[ad_2]

Source website link