McEwen Mining Stock: An Inferior Way To Buy The Dip (NYSE:MUX)

[ad_1]

Falcor/E+ via Getty Images

We’re more than three-quarters of the way through the Q1 Earnings Season for the Gold Juniors Index (GDXJ) and one of the most recent companies to report its results is McEwen Mining (NYSE:MUX). Unfortunately, the Q1 results were mediocre at best, with production down 18% year-over-year and all-in sustaining costs soaring above $2,100/oz at its 100% owned operations. This translated to more net losses despite the strength in the gold price. At a sub $250 million market cap, MUX is cheap, but I think there are dozens of better ways to play the sector-wide correction.

Black Fox Operations (Company Website)

Just over two months ago, I wrote on McEwen Mining, noting that the stock had limited downside at current metals prices. This view was based on the fact that at $2,000/oz gold and $26.00/oz silver, the company might be able to turn a profit finally, and its year-over-year comparisons were so easy that it would be difficult for the company to do any worse. Hence, I saw the stock as a Speculative Buy at US$0.74. Perhaps, I should have underlined and bolded “at current metals prices“, because, with two poor marginal assets and metals prices pulling back, my view that the downside was limited has been brutally incorrect. Let’s take a look at the most recent quarter:

Production

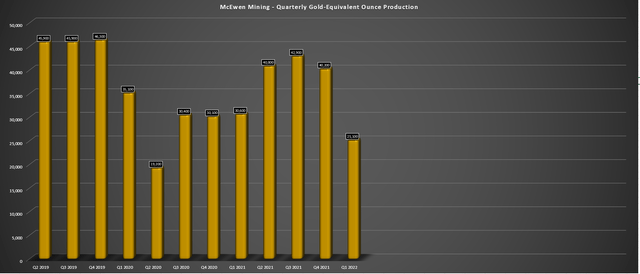

McEwen Mining released its Q1 results earlier this month, reporting quarterly production of ~20,800 ounces of gold and ~336,500 ounces of silver, or ~25,100 gold-equivalent ounces [GEOs]. This translated to an 18% decline on a year-over-year basis, with the softness related to a very slow start to the year at its Gold Bar Mine in Nevada. The weaker production was related to mining at the Pick open pit being below target due to mining contractor employee turnover, lower blasting productivity, and the segregation of potentially preg-robbing carbon in mineralized material. The result? A 15% decline in gold production year-over-year and further impacts to be felt in the Q2 results due to the ore losses to carbon.

McEwen Mining – Quarterly GEO Production (Company Filings, Author’s Chart)

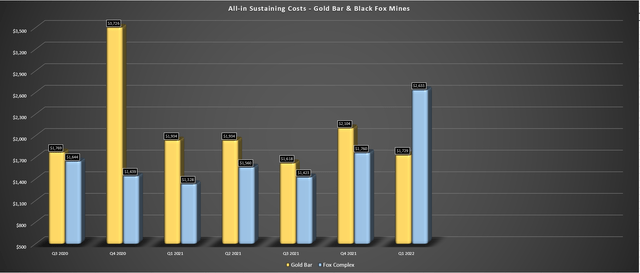

Looking at the chart below, we can see that this was the worst quarter for McEwen Mining since Q2 2020 from a GEO production standpoint and the worst quarter for Gold Bar since Q4 2020, with just 6,300 GEOs produced. Given that the mine is tracking at just 15.4% of its guidance mid-point with another soft Q2 ahead, meeting the guidance mid-point could be difficult, suggesting that production from McEwen’s operating assets could come in near the upper end of the guidance range of $1,570/oz to $1,690/oz. In Q1 alone, Gold Bar’s costs came in ~$750/oz higher than the gold price at $2,633/oz.

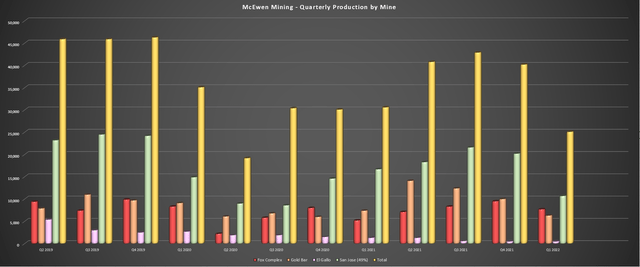

McEwen Mining – Quarterly Production by Mine (Company Filings, Author’s Chart)

The only silver lining at Gold Bar is that the company has been able to isolate the mineralized material with preg-robbing carbon to date, allowing the operation to maintain its gold recovery rates. Meanwhile, the company received its environmental approval for Gold Bar South in April, with mining able to begin here before year-end, representing another mining center that at least could diversify away from the Pick deposit if the carbonaceous material continues to present an issue.

Pick Pit, Ridge Pit, and Gold Bar South (GBS) (Company Technical Report)

While the company is confident in lower costs going forward at Gold Bar, I am less optimistic about this asset. This is because low-grade, high-volume assets are ones affected considerably by the inflationary pressures given the significantly higher material being moved and processed, making these assets more sensitive to rising diesel prices and rising consumables costs. The recent disclosure about carbonaceous material certainly doesn’t help matters, with the potential for less recovered ounces from tonnes mined than previously expected, even if the material can be separated.

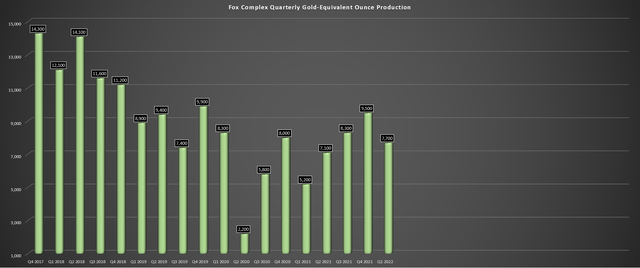

Fox Complex – Quarterly Gold Production (Company Filings, Author’s Chart)

If Gold Bar’s weak performance were the only underperformer in the quarter, the Q1 results might not have been as ugly. H

owever, the Fox Complex didn’t see a much better Q1, producing just ~7,700 GEOs. From a headline standpoint, this was up 47% year-over-year. However, the Fox Complex was up against very easy year-over-year comps, with mining at the Black Fox Mine winding down in Q1 2021. The lower than planned production in the period was affected by COVID-19 related isolation requirements, higher than normal snowfall, and an unplanned cone crusher rebuild.

As it stands, production is sitting at just 16.5% of the mine’s annual guidance mid-point, and McEwen Mining noted that it is confident in meeting its forecasted FY2022 production. The good news is that 11,700 ounces were mined, and production would have come in at 10,500 ounces if the material had all been processed, so the quarter wasn’t as bad as it looked. Still, with inflationary pressures worsening, it’s less clear whether the company will be able to justify the expansion project to extend the mine life, which had only a 21% after-tax IRR with operating cost estimates that now look ambitious ($769/oz). During the quarter, costs came in at $1,729/oz but should improve throughout the year.

Finally, production wasn’t much better at the San Jose Mine in Argentina, where McEwen Mining’s attributable share of production (49% interest) came in at just ~10,700 GEOs. This was well below the ~16,700 GEOs produced in Q1 2021. Looking back long-term, this figure was more than 50% vs. the FY2019 quarterly average of ~23,000 GEOs. Hochschild (OTCQX:HCHDF) noted that production was impacted by COVID-19-related absenteeism, affecting throughput in the quarter, and that production will improve from Q1 levels.

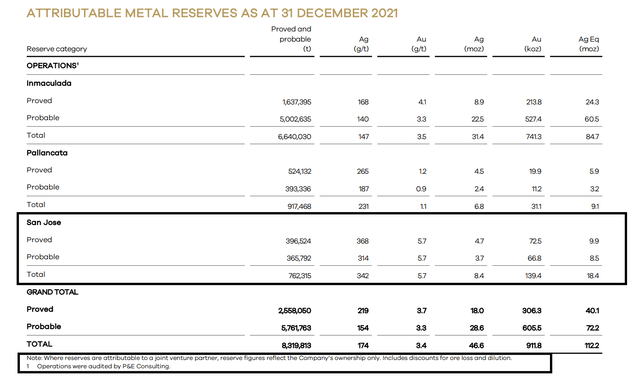

While production will bounce back, this is the only decent operating asset in MUX’s portfolio, and it has a relatively short mine life, with just ~1.5 million tonnes in the Proven & Probable reserve category. This represents three years of mine life, assuming a similar production rate to FY2021 (~540,000 tonnes). Therefore, MUX has two marginal assets (Gold Bar and Fox) and the one asset that has historically been more consistent is staring down a relatively short mine life. Reserve replacement is possible, but I’m not overly optimistic given that Hochschild is using very generous metals price assumptions for reserves ($1,800/oz gold, $26.00/oz silver).

Hochschild Mining – 2021 Mineral Reserves (Attributable tonnes at San Jose) (Hochschild Mining Annual Report)

Overall, Q1 production was mediocre at best. While we will see sequential improvement, there’s now some added uncertainty about the company’s already marginal asset, Gold Bar. This is due to the preg-robbing carbon in some of the mineralized material. Given the weak gold sales, McEwen’s all-in sustaining costs at its 100% owned operations came in at nearly double the industry average ($1,190/oz) at $2,146/oz, leaving little room for profitability in the period. Looking ahead to Q2, costs will improve, but I would expect to see some partial offset from higher diesel prices and consumables costs.

Black Fox/Gold Bar – Quarterly AISC (Company Filings, Author’s Chart)

Margins & Financial Results

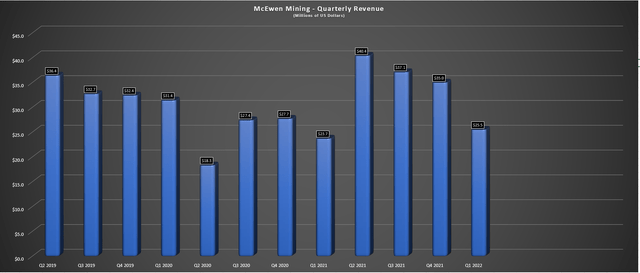

As the chart below shows, McEwen Mining saw higher revenue in Q1 2022 ($25.5 million vs. $23.7 million), helped by a higher average realized gold price of $1,895/oz. However, it’s important to note that McEwen Mining was lapping extremely easy year-over-year comps from Q1 2021 due to relatively low gold sales and a very weak gold price. If we compare these results with a more normalized period, such as Q4 2019, after starting commercial production at Gold Bar, revenue is down more than 20%. This is even worse when factoring in the significant increase we’ve seen in the gold price ($1,890/oz vs. ~$1,500/oz), which should have been a tailwind.

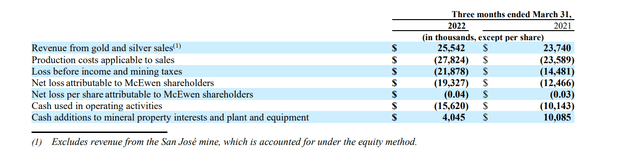

McEwen Mining – Quarterly Revenue (Company Filings, Author’s Chart)

Given the sharp decline in revenue and negative AISC margins of $250/oz, it’s no surprise that McEwen Mining reported more losses in Q1 2022. During the quarter, the company’s cash gross loss came in at $2.3 million, and its gross loss came in at $6.0 million. Meanwhile, its net loss came in at $19.3 million after including capital expenditures related to exploration and the advancement of Los Azules. This is not very encouraging for long-term investors in the stock, given that the thinking was that if the gold price could just get above $1,900/oz, the company might finally be profitable.

McEwen Mining – Quarterly Financial Results (Company Filings)

The only good news is that McEwen Mining is sitting on ~$70 million in cash and should get through the year without additional share dilution, assuming the gold price can stay above $1,750/oz. However, this is the bare minimum one would expect from a gold producer. Besides, the only reason that the cash balance is in a satisfactory position is that we saw additional share dilution to start the year. The progression in the share count is shown below, with zero production growth per share over the past decade.

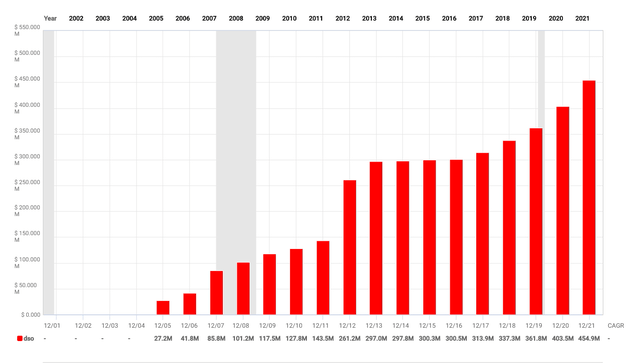

McEwen Mining – Share Count (FASTGraphs.com)

The whole point behind owning gold producers vs. their riskier peers (gold developers) is that investors can look forward to regular dividends, production growth, and meaningful free cash flow generation. In McEwen Mining’s case, investors can look forwar

d to none of these things, and consolidated production has increased just 20% in the past decade (2013-2023 estimates) while the share count has nearly doubled. Given that the company will see AISC margins below $250/oz in FY2022, I would not expect to see a dividend either. In fact, I would not be surprised to see the track record of share dilution continue, with further share dilution over the next 18 months unless MUX gets help from the gold price.

Valuation

Following the most recent financing in Q1, McEwen Mining has ~474 million shares outstanding, translating to a market cap of ~$256 million at a share price of US$0.54. Assuming McEwen Mining was profitable, this would be a very reasonable valuation for a Tier-1 jurisdiction gold miner that is producing ~100,000 ounces per annum at its operations, with a 49% interest in a ~70,000-ounce per annum producer. However, McEwen Mining is barely profitable at current metals prices, with its 100%-owned operations likely to see all-in costs come in north of $1,700/oz.

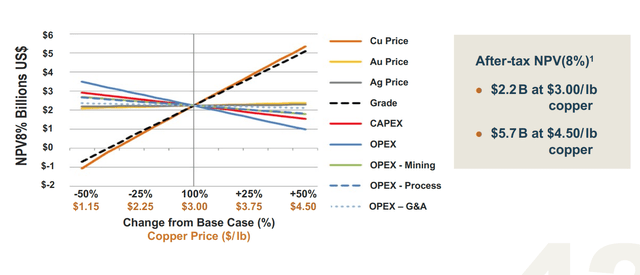

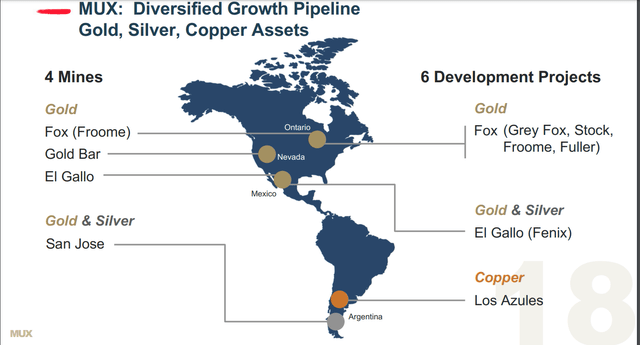

The one redeeming quality is that McEwen Mining does hold a majority interest (69%) in the massive Los Azules Copper Project in Argentina, which is home to over 10 billion pounds of copper, 1.7 million ounces of gold, and 55 million ounces of silver in the Indicated resource category. According to the 2017 Preliminary Economic Assessment, Los Azules is capable of producing over 400 million pounds of copper per annum at sub $1.50/lb cash costs, with an After-Tax NPV (8%) of $2.2 billion ($3.00/lb copper prices).

Even if we assume a higher-cost build due to inflationary pressures, and a P/NAV multiple of 0.15 on a $2.0 billion After-Tax NPV (8%) with ~$3.50/lb copper, McEwen’s share of the project is worth nearly $210 million, or more than 80% of its current market cap. The problem is that in a worsening inflationary environment, I’m not sure how many larger producers will be hungry to build a mine with upfront capex of $3.0+ billion (adjusting for at least 20% higher costs), potentially hurting the takeover target thesis for McEwen Mining.

Los Azules – NPV Sensitivity (Company Presentation)

Assuming we give McEwen Mining credit for a conservative value of $246 million at Los Azules, McEwen Mining may look very cheap. However, I think it’s hard to argue that McEwen’s other assets are worth more than $125 million (~$370 million total). This is because the only real profitable asset is San Jose, and it’s less clear whether Gold Bar and Black Fox can make money after adjusting for inflationary pressures (fuel, consumables, and labor) and the fact that the operations continue to struggle with regular operational misses.

To summarize, while I think a case can be made that McEwen Mining can command a valuation of ~$370 million based on 49% interest in San Jose and 82% interest in Los Azules, this still only translates to a value of US$0.78 per share (474 million shares outstanding). This may represent more than 40% upside, but I think there are much safer ways to find 40% upside in this market, and some names are offering 60-80% upside from current levels elsewhere in the sector with much stronger business models.

McEwen Mining – Asset Portfolio (Company Presentation)

To summarize, I remain Neutral on McEwen Mining, even if the stock is well below its highs, and see an oversold bounce. This is because when the sector is on sale, it makes sense to focus on quality, not sector laggards in intermediate downtrends that are likely to run into strong selling pressure on any rallies. My preference from a buy-the-dip standpoint would be companies like Osisko Gold Royalties (OR) that trade at a deep discount to net asset value with industry-leading margins. If I did own MUX, I would view rallies to the US$0.70 level as profit-taking opportunities.

[ad_2]

Source link