Meta Vs. TikTok Vs. YouTube Shorts: The Winner Is Clear (NASDAQ:META)

[ad_1]

Fritz Jorgensen/iStock Editorial through Getty Photographs

Meta Platforms (NASDAQ:META) has been striving a amount of initiatives to increase its expansion runway. The most critical energy is in its Reels aspect the place we are seeing a fast enhance in person engagement. Meta’s achievements in Reels will be essential since it reveals the means of the organization to quickly adapt to new traits within the social media sector. The administration has declared that Reels will make up much more than 20% of the time buyers invest on Instagram and videos have cornered 50% of the time invested on Fb. This is a substantial improve for Fb.

The monetization of the time invested on Reels is nonetheless low as the corporation is focusing on enhancing consumer engagement. However, Meta has shown in the past couple several years that it can improve monetization in new initiatives irrespective of reservations by Wall Avenue. This was obviously viewed in the Stories aspect which was considered to have a lower potential for monetization but has turned out to be an fantastic system for advertisers.

The dip in earnings progress in the current quarters is owing to extra individuals relocating in the direction of Reels and the actuality that Meta has not began monetizing this function fully. The following handful of quarters must see larger user engagement in Reels and a swift go towards monetization which should improve Meta’s vital metrics like revenue and income development which will improve the sentiment in the direction of the inventory on Wall Avenue. At a P/E ratio of 12, Meta stock is a Robust Obtain for long-term buyers ready to wait out the present headwinds.

Reels is the future

Meta has made some big changes in its platform above the previous few decades. It is likely that we will see a huge change to movie structure as buyers come to be accustomed to this media. Reels is the vital element that will help Meta go into a online video-initial platform. By now, Reels has cornered around 20% of the total time used by users on Instagram. This quantity can improve quickly as the corporation focuses on bettering the ecosystem for creators.

There is a significant bonus method where Meta has allocated $1 billion for creators who have large engagement on Reels. This program is even now fluid but focuses on growing consumer engagement. The Verge write-up mentions that creators have been provided as considerably as $1,000 for each million views. This is pretty a excellent payout for shorter-sort films.

Meta has the assets to double down on assisting creators maximize the person engagement on Reels. TikTok has a short while ago released its first advert product or service and is furnishing a superior earnings share for creators. This is a little something we ought to see from Meta in the near upcoming as creators are presented with new prospects to monetize their video clips. It ought to be mentioned that Meta is shelling out massively on Truth Labs with annual losses of around $10 billion. The firm could easily shell out a fraction of that amount on a successful characteristic like Reels to increase person engagement and monetization.

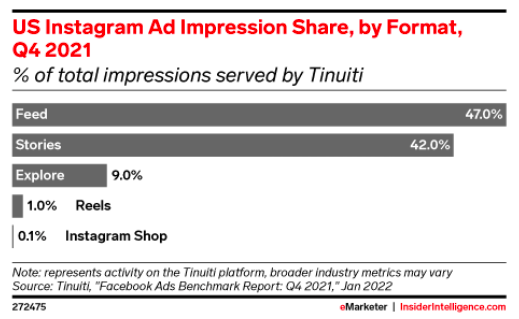

eMarketer

Determine 1: Advert impressions on Reels is nonetheless really reduced as opposed to Feed and Stories. Source: eMarketer

A current eMarketer report demonstrates that the ad impressions on Reels is continue to very very low when compared to other functions. At the identical time, person engagement on Reels is fast developing. This could be a vital explanation behind the dip in revenue growth. Having said that, this dip is likely to be temporary as Meta starts ramping up the monetization of Reels in the subsequent few quarters.

Reels vs Shorts vs TikTok

There is a struggle amid social media Goliaths inside of the short-form video clip structure. Reels straight competes with YouTube’s Shorts and TikTok. YouTube described YoY profits growth of only 14% in the latest quarter in comparison to analyst expectation of 25%. A large explanation for this drop in earnings progress was documented to be the swift expansion in YouTube Shorts. Far more buyers commit time on Shorts which minimizes the general advert profits. TikTok has also moved toward launching advertisement products. This will lead to robust opposition in between these rivals to catch the attention of extra users and produce a lot more advertisements to them.

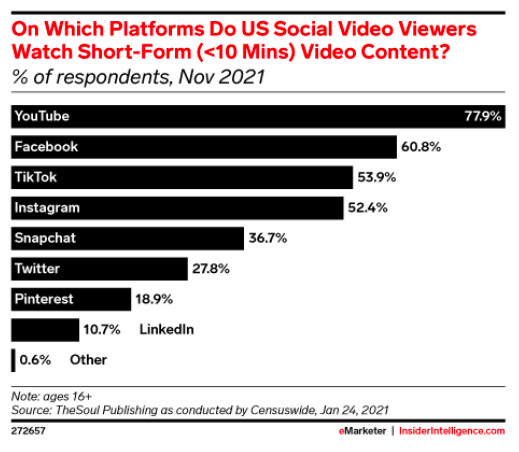

eMarketer

Figure 2: Use of distinctive platforms to look at brief-form video clips. eMarketer

Reels has a quantity of positive aspects versus other shorter-kind online video platforms. We are nonetheless in the early stages of short-type movie media. As this format results in being more common amid buyers, we really should see a a lot more “social factor” to these films. Meta has massive details on the passions, track record, likings, and other facets of a person. This really should allow for the firm to develop improved algorithms to boost consumer engagement. Both TikTok and YouTube Shorts deficiency in-depth data about buyers which Meta has. The community influence will occur into engage in inside the limited video structure also. This will sooner or later be a key edge for Meta versus other rivals.

Progress probable

Wall Avenue is possible underestimating the future scope of Reels platform. We noticed a related warning all through the early levels of Tales when most of the analysts questioned the capability to deliver adverts on that system. Meta has the assets and social community to divert additional buyers in direction of Reels and enhance the engagement metric. The current very low monetization charge in Reels will surely lead to brief-term headwinds for the leading line and base-line advancement. We have by now found this in the earlier few quarters.

Nevertheless, more than the subsequent couple quarters, we need to see a rapid improve in monetization within the Reels system. This will reignite the income and gain progress price trajectory of Meta and also enhance the sentiment on Wall Street.

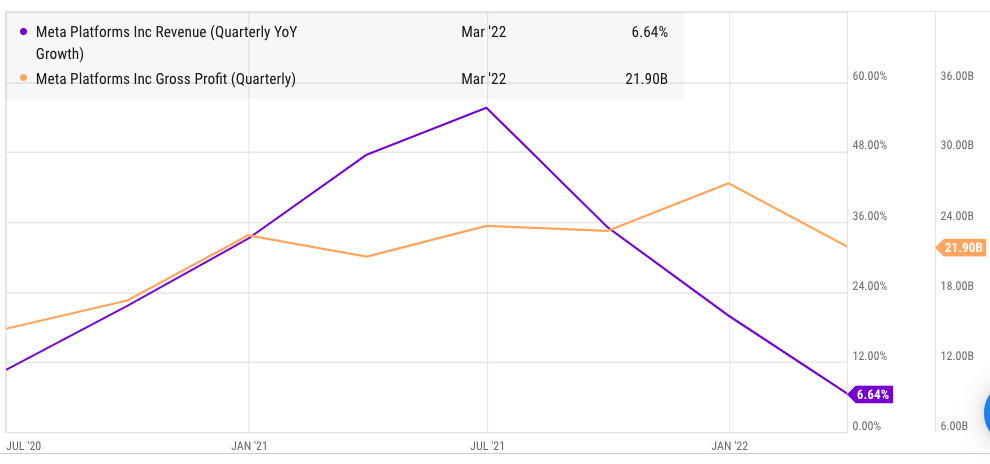

YCharts

Determine 3: Dip in YoY development owing to tougher comps and advancement of lessen monetizing system like Reels. Source: YCharts

Affect on Meta Stock

Reels is possessing a significant affect on the direction of Meta stock. It is 1 of the crucial causes guiding the dip in revenue and gain advancement in the final few quarters. This has soured the sentiment of Wall Avenue in direction of the inventory. Meta stock has now fallen by close to 50% yr-to-day as opposed to fewer than 25% drop in other Massive Tech shares like Apple (AAPL) and Alphabet (GOOG) (GOOGL).

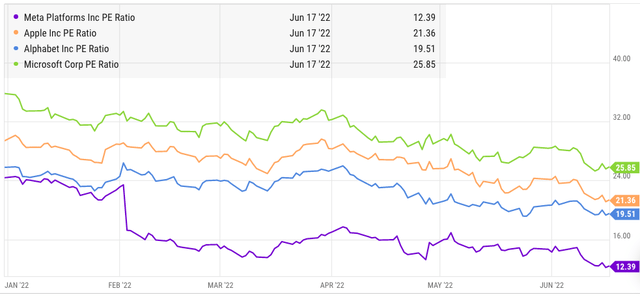

YCharts

Determine 4: Meta is buying and selling at a massive discounted as opposed to other tech shares. Resource: YCharts

The Reels characteristic may choose a handful of far more quarters to demonstrate great benefits. During this time, the earnings growth for Meta will continue to be hard. On the other hand, long-expression buyers can consider gain of the rock-base price in META inventory to gain a improved entry position.

YCharts

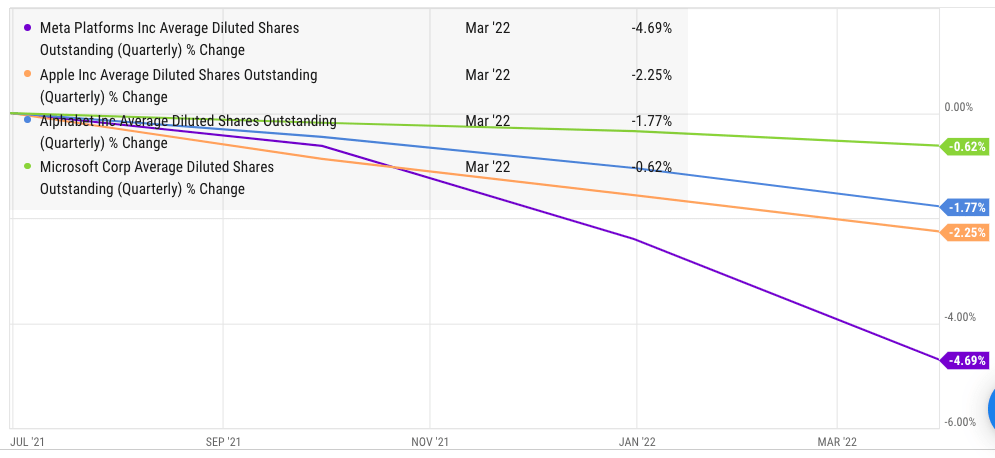

Figure 5: Meta has expunged close to 5% of its fantastic inventory in the very last twelve months. Source: YCharts

It is also vital to notice the trend in buybacks. Meta used above $50 billion on buybacks in the previous twelve months which has expunged shut to 5% of its remarkable inventory. This is a lot even larger than Apple, Alphabet, or Microsoft (MSFT). Meta generates $40 billion in free dollars move which should really permit it to carry on the present speed of buybacks. At the latest rate stage and buyback pace, META could expunge far more than 10% of the remarkable stock each year. This degree of buybacks can be preserved for a quantity of several years owing to healthy FCF and cash reserves.

Extensive-expression investors would profit from this development as the EPS of Meta inventory improves substantially about the subsequent couple of quarters.

Investor Takeaway

Meta is placing a great deal of concentrate and sources into improving user engagement on Reels. The administration has pointed out that 20% of person time invested on Instagram was on Reels. The monetization of this feature is nonetheless very low as the company is focusing on enhancing person engagement. Having said that, Meta is in a fantastic placement to develop a robust advert revenue stream from Reels because of to its current tools.

Meta is at a significant benefit as opposed to YouTube Shorts and TikTok since of its social media platform. The community influence will get started demonstrating in brief-sort films which will assistance Fb build a superior algorithm than rivals and improve the person engagement relying on their fascination and track record.

Meta stock is investing at a large price reduction compared to other tech majors. We must continue on to see headwinds for revenue and gain development in the near time period. But prolonged expression investors could get greater returns due to the current rock-base inventory price tag. Facebook is also enterprise a enormous buyback system which really should enable the company improve its EPS by double-digit per year on a standalone foundation. This craze will be a huge tailwind for very long-term returns on Meta’s stock. The fundamentals of the company are however extremely solid and the minimal stock selling price would make it a Solid Purchase for prolonged-phrase investors.

[ad_2]

Resource backlink