Microsoft Vs. Oracle: Which Stock Is The Better Buy

[ad_1]

rvlsoft/iStock Editorial via Getty Images

Microsoft (NASDAQ:MSFT) and Oracle (NYSE:ORCL) are among the handful of tech companies which survived the 2000-2003 dot.com/NASDAQ crash more or less intact. What enabled them to survive was the fact that, unlike many of the popular NASDAQ growth stocks of the time, they were very much real and successful businesses. It was mainly the extreme overvaluation of tech stocks at that time that caused their prices to crash. The weaker ones never recovered. Now that two decades have passed, both Microsoft and Oracle have continued to be profitable businesses and do well in market price. But which is the better investment?

The answer to this question is not easy and obvious. Stated in the simplest form, Microsoft has done a lot better with reconstituting its business and reigniting strong growth, but it is a very expensive stock selling at around 30 times earnings. To justify that price it must continue to do extremely well. That’s a risk that comes with all growth stocks, particularly those which have become so large that growing is increasingly difficult. Microsoft is currently the number two stock by market cap in the S&P 500 Index (VOO) after Apple (AAPL). Oracle has done just okay but still aspires to growth as its actions show. It is currently, however, more of a value stock and sells at just under 15 times earnings.

Your choice as to which stock is the better investment will depend to a large degree on whether you look first at growth or first at value. Growth enthusiasts will undoubtedly prefer Microsoft which is expensive, but not entirely out of line by comparison to other growth leaders. Warren Buffett would almost certainly prefer Oracle, especially considering his recent purchase of HP (HPQ), formerly Hewlett Packard, which like Oracle was once a growth stock but has now, even more than Oracle, settled into a value stock. To anchor a sense of Microsoft versus Oracle it seems appropriate to compare their long term price charts earlier in this article than usual.

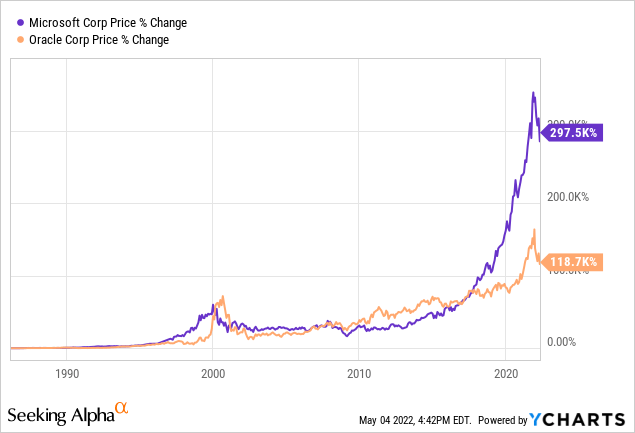

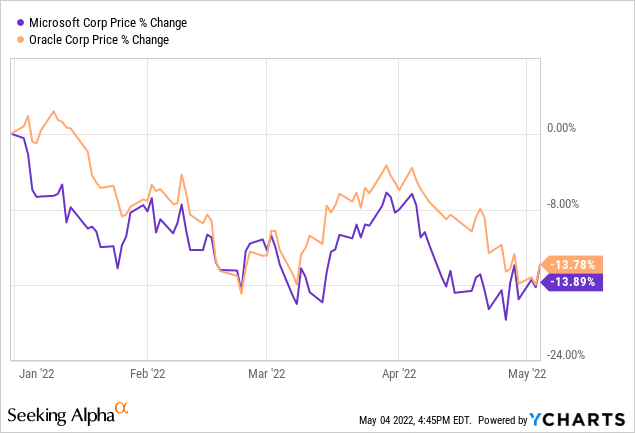

The above chart does a pretty good job of telling the story of the two companies. Both gradually rose from the middle 1980s until 2000, and a little after when they were caught up in the dot.com boom. Oracle stayed near the peak a couple of years longer before joining in the crash. It then fell to a bottom below Microsoft’s before outperforming until 2018. In 2018 the market must have seen MSFT and ORCL as pretty similar. Microsoft then got a second wind of strong growth and raced ahead to lead the last phase of the tech stock bull market until late 2021. Its chart from 2016 through 2021 looks like a rocket ship blasting off. The chart below shows that both Microsoft and Oracle were hammered in the 2022 growth stock debacle and have performed about the same.

Numbers Flesh Out The Message Of The Charts

Microsoft has the operating metrics one might expect from a growth stock, albeit a very large company for which continuing growth presents a challenge. Revenues, Net Income, and Long Term Debt are in billions. Shares Outstanding are in millions. Earnings Per Share and Free Cash Flow have dollar marks.

| MSFT | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | TTM |

| REV | 78 | 87 | 94 | 91 | 97 | 110 | 126 | 143 | 168 | 193 |

| INC | 21 | 22 | 12 | 21 | 25 | 17 | 39 | 44 | 61 | 72 |

| SHS | 8.5 | 8.4 | 8.3 | 8.0 | 7.8 | 7.8 | 7.8 | 7.7 | 7.6 | 7.6 |

| LTD | 13 | 21 | 28 | 41 | 76 | 72 | 67 | 60 | 50 | 48 |

| EPS | $2.58 | $2.63 | $1.48 | $2.56 | $3.25 | $2.13 | $5.06 | $5.76 | $8.05 | $9.58 |

| FCF | $2.93 | $3.26 | $2.90 | $3.15 | $4.05 | $4.19 | $4.99 | $5.94 | $7.44 | $8.48 |

Note that revenues increase more than 2.5X in less than nine years while net income increased 3.4X. Long term debt increased until 2017 then declined a bit, being currently a bit under 19% of enterprise value. Earnings almost quadrupled although free cash flow per share did not grow quite as fast. Microsoft is not a huge buyer back of stock but shares outstanding fell over 10%.

Here are the same metrics for Oracle.

| ORCL | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | TTM |

| REV | 37 | 38 | 38 | 37 | 38 | 39 | 40 | 39 | 40 | 42 |

| INC | 11 | 11 | 10 | 9 | 9 | 4 | 11 | 10 | 14 | 8 |

| SHS | 4.8 | 4.6 | 4.5 | 4.3 | 4.2 | 4.2 | 3.7 | 3.3 | 3.0 | 2.8 |

| LTD | 18 | 23 | 40 | 40 | 48 | 56 | 52 | 69 | 76 | 72 |

| EPS | $1.77 | $1.92 | $1.84 | $1.73 | $1.81 | $1.93 | $2.13 | $2.33 | $2.72 | $2.82 |

| FCF | $2.85 | $3.17 | $2.99 | $2.96 | $2.94 | $3.31 | $3.55 | $3.60 | $4.67 | $2.40 |

Unlike Microsoft, Oracle has neither top line growth nor growth in Net Income. Its Long Term Debt has quadrupled over less than nine years, more or less the same as Microsoft though without the recent move in the direction of debt reduction. The one metric which moved strongly in a positive direction was shares outstanding, which fell by 42% over the nine years. While total earnings were flat, the share reduction almost exactly accounts for the increase in per share earnings, which rose 60% over the period. In short, Oracle manufactured per share growth in earnings.

Both Microsoft and Oracle increased their dividends over the period. Microsoft’s dividend per share tripled while Oracle’s dividend quintupled. Microsoft’s payout ratio actually declined by a third, however, while Oracle’s payout ratio rose from 13% to 49%. That pace can’t go on forever without a step up in growth. Oracle’s yield, at 1.74%, is almost double Microsoft’s 0.89%.

The contrasting picture of the two companies is clear. Microsoft is a mega cap growth stock. Its main future challenge is the usual difficulty in moving the needle enough to continue growing in a very large company. The strong growth in Azure cloud is encouraging, but competition is intense with Amazon’s (AMZN) AWS still having a 50% larger market share than Microsoft. Azure would have to continue to pull ground in the cloud area for Microsoft to have a shot at justifying its current high P/E ratio. Oracle is a value company, pure and simple. It manages shareholder returns while fighting to hold onto modest increases in revenues and income. Microsoft is more than ten times the size of Oracle as measured by market cap, although it should be remembered that the Microsoft market cap of over $2 trillion is aided by the fact that its price earnings ratio (P/E) is twice that of Oracle, which has a market cap just under $200 million.

Both Microsoft And Oracle Have Major Acquisitions In The Works

After the dot-com crash of 2003 both Microsoft and Oracle managed to maintain and expand their core businesses by making acquisitions that kept them up to date with new and emerging technology and business models. For both companies this has meant acquiring companies to enhance their position with cloud and interface with business customers. For Microsoft it has also meant establishing itself in both the healthcare business with Nuance for $19.7 billion in 2021 and the gaming industry with the acquisitions of Skype and most recently the 2020 $8.1 billion acquisition of ZeniMax, noting at the time that gaming was the fastest growing part of the entertainment industry.

Oracle is the legendary king of acquisitions, having made 144 in recent years, 29 of them being private equity. Much of Oracle’s focus has been in areas of enterprise resources and software, scooping up dot.com era favorites like Sun Microsystems (2010) and sometimes individual talent from that era such as in BEA Systems (2008) which was founded by three former Sun Micro employees. In its enterprise and IT business, it ranks second behind, of course, #1 Microsoft. The third and fourth in the sector are SAP (SAP) and fast growing Salesforce (CRM). Microsoft and Oracle, though not alone, are very much direct competitors in the enterprise and IT business.

While both companies have been aggressive and to a degree successful in the effort to buy growth, their high level of activity also calls attention to the fact that organic growth has been hard to achieve on a meaningful scale, for Microsoft because of its size, but especially for Oracle. Current acquisitions in the works play to the relative strengths and interests of the two companies. Microsoft has an acquisition in progress with Activision Blizzard (ATVI) and will be the third largest gamer if the deal goes through and acquires Call of Duty, Warcraft, Diablo, and Candy Crush.

The bid for ATVI is $68.7 billion and the major obstacle at this point may be the EU, to which any acquisition by a large US tech company raises immediate alarm. I can’t really evaluate the game values or the threat to competition. My only experience with gaming involved the brother of an outstanding tennis student of mine who couldn’t tear himself away from Warcraft long enough to build on his considerable physical capabilities. My view is simple and encompassing: from the standpoint of general societal well-being and the ability of young people to forge a real existence in the real world, this stuff is awful! It makes money, though. Here are the revenue and net income lines for ATVI in $ billions rounded:

| 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | TTM | |

| REV | 4.6 | 4.4 | 4.7 | 6.6 | 7.0 | 7.5 | 6.5 | 8.1 | 8.8 | 8.3 |

| INC | 1.0 | .8 | .9 | 1.0 | .3 | 1.8 | 1.5 | 2.2 | 2.7 | 2.5 |

Oracle’s acquisition in progress is Cerner (CERN), the leader in healthcare IT. Cerner’s major clients include the VA and Department of Defense, and the acquisition promises to give Oracle an edge in competition with Microsoft’s Nuance. Here are the revenue and net income lines for CERN in $ billions rounded.

| 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | TTM | |

| REV | 2.8 | 3.3 | 4.4 | 4.8 | 5.1 | 5.4 | 5.7 | 5.6 | 5.8 | 5.8 |

| INC | .58 | .78 | .87 | .95 | .96 | .78 | .75 | .90 | 1.1 | 1.1 |

Presuming both deals go through, Microsoft and Oracle are acquiring growth on about the same scale. At the present moment, however, the probability of success is higher for Oracle than Microsoft. The Microsoft bid for ATVI is $68.7 billion, and the major obstacle at this point may be not just the EU, but US politicians looking to make a point. Activision Blizzard is selling around $79 per share against a deal price of $95. At the recent Berkshire Hathaway (BRK.A)(BRK.B) Annual Meeting, Warren Buffett as CIO at Berkshire had bought ATVI as an arbitrage bet, which caused ATVI to edge up a couple of dollars. The odds favor Microsoft. Oracle’s deal for Cerner seems almost certain with CERN stock trading very close to the bid price.

Assuming both deals go through, the impact on the two companies will differ quite a bit. ATVI would be about 3.5% of Microsoft’s market cap while CERN would be over 14% of Oracle’s – more than four times as important. Its impact on Oracle’s future growth would be much greater.

MSFT Ratings, Factor Grades, And Quant Summary

Quant Rankings:

Ranked in Industry (Systems Software) 4 out of 46

Ranked in Sector (Information Technology) 119 out of 598)

Ranked Overall 1915 out of 4359

Quant rankings beat the market

Quant Rankings: Ranked in Industry (Systems Software) 1 out of 46 Ranked in Sector (Information Technology) 55 out of 598 Ranked Overall 509 out of 4359 Quant ratings beat the market Some of the comparisons of MSFT and ORCL are obvious and easy to explain. Microsoft’s longer term positive movement in market price was sustained by an outstanding recent earnings report, thus the Momentum rank of A- versus B for Oracle. The same is true of revisions. Both companies have clearly earned the A+ grade for profitability. Given the fact that Microsoft’s P/E is double that of Oracle it’s not surprising that its Valuation is D- versus Oracle’s C. Idiosyncratically I might have given Oracle a B-. The big surprise is that Oracle’s growth grade has surged from F to D- to A- over six months to three months to the present. Looking at the ORCL growth numbers in detail, its ratings by category are in the D range for Revenue Growth, EDITDA Growth, EBIT Growth, EPS Growth, Free Cash Flow Growth, and Operating Cash Flow Growth. The Microsoft numbers in these categories are all in the B to C range, yet MSFT gets an overall D+ ranking while ORCL gets an A-, having moved up over six months from F. The only explanation I can think of is that there is recency emphasis on some numbers, although that appears inconsistent with MSFT’s recent earnings. Oracle does do better getting an A+ for Return on Equity Growth and an A- for CAPEX Growth, two admittedly important categories both of which are among the six Growth criteria in the CRSP indexes. Microsoft gets a C- and C+ respectively in these categories. As far I can see, Oracle’s growth leads or matches Microsoft only in per share numbers manufactured by buybacks which have produced a large decline in shares outstanding. Microsoft is the growth stock, Oracle is the value stock. That’s my story and I’m sticking to it. Deciding which of the two is the better buy is a straight up comparison between moderate growth at a very high price and no fundamental growth at a value price. If you are a pure growth stock investor you can probably get past the risks and the very high valuation and choose Microsoft. A growth stock often deserves the benefit of the doubt as the better long term investment. Microsoft’s Azure cloud has a decent chance of continuing its outstanding growth for at least a few years, and the Activision Blizzard deal will probably get past the regulators. The thing I must draw your attention to is the fact that 30 times earnings means, inverted, a 3.3% earnings yield. That might be okay for a stock with very rapid growth, 20% or so, but that’s not Microsoft. Microsoft is a great company with a great CEO in Satya Nadella who has done everything right. You can look at Microsoft’s comeback since the 2000-2003 NASDAQ crash and admire. I just can’t talk myself into the valuation. The Oracle case is pretty much the flip side. Oracle has no real organic growth. Most of what it does is sort of a treadmill on which it has to run hard to stay in the same place. Thus the constant acquisitions. What growth it has in Earnings Per Share and Free Cash Flow is manufactured with share buybacks. There’s nothing wrong with that. Property and casualty insurance companies have done more or less the same over the better part of two decades while the underwriting business has been tough and investment returns have been minimal because of low rates. They have been satisfactory safe investments, however, because relentless share buybacks have manufactured per share earnings growth and enabled consistent dividend growth. Did I just compare hyperactive acquirer Oracle to insurance companies, the most dull and pedestrian businesses on earth? I did, but there’s one major difference. Oracle has done its 144 acquisitions merely to enable it to run in place. Go back for another look at its top line revenues and net income. It took all those acquisitions just to keep its top line pretty much constant – up a bit over 10% for the decade. So why is it that I feel myself tilting a bit in the direction of no-growth Oracle? There are a couple of reasons, starting with valuation. If Buffett is to buy one of these two stocks, it’s probably Oracle. The problem with growth, especially for a giant company like Microsoft, is that it gets harder and harder to maintain a high rate of growth over many years. It can beat quarterly forecasts much of the time for a while, but it’s just hard to maintain those beats with comparisons to past numbers. Yet that’s just what is priced into Microsoft stock. It’s also hard to be Oracle, pushed to frenetic acquisitions just to run in place. It’s just not as tough as it is to sustain growth for a $2 trillion company. I also like its acquisition of Cerner more than I like the Microsoft deal for ATVI. It’s not distaste for the business nor even the clear risk that the deal won’t go through. It’s that CERN is over 14% of Oracle’s market cap, enough to make a bit of difference and relieve the pressure to wheel and deal at least for a while. The comparison is easy because both CERN and ATVI have similar growth CAGRs. And CERN is a done deal. If I’m buying one of them, which I am probably not, it’s Oracle.

Factor Grades

Now

3M ago

6M ago

Valuation

C

C

D

Growth

A-

D-

F

Profitability

A+

A+

A+

Momentum

B

B

A-

Revisions

C

B

C+

MSFT Vs ORCL: Comparison By Ratings, Factor Grades, and Quant Summary

So Which Is The Better Long Term Buy, The Value Stock Or The Growth Stock?

[ad_2]

Source link