Valmont Industries (VMI) Reviews Next Week: Wall Road Expects Earnings Advancement

The industry expects Valmont Industries (VMI) to produce a calendar year-in excess of-calendar year improve in earnings on higher revenues when it reports effects for the quarter finished June 2021. This extensively-identified consensus outlook is critical in assessing the company’s earnings image, but a strong issue that might influence its close to-term inventory price is how the true effects examine to these estimates.

The earnings report, which is envisioned to be released on July 21, 2021, may well aid the stock transfer higher if these important quantities are improved than expectations. On the other hand, if they miss out on, the stock may possibly go lower.

Whilst the sustainability of the quick rate adjust and long run earnings anticipations will primarily count on management’s dialogue of business circumstances on the earnings phone, it’s worth handicapping the chance of a favourable EPS shock.

Zacks Consensus Estimate

This infrastructure products maker is expected to put up quarterly earnings of $2.51 per share in its future report, which signifies a yr-more than-year adjust of +25.5%.

Revenues are predicted to be $815.63 million, up 18.4% from the calendar year-back quarter.

Estimate Revisions Development

The consensus EPS estimate for the quarter has remained unchanged above the past 30 days. This is essentially a reflection of how the masking analysts have collectively reassessed their initial estimates in excess of this period.

Buyers really should retain in mind that the course of estimate revisions by each of the covering analysts could not always get mirrored in the mixture change.

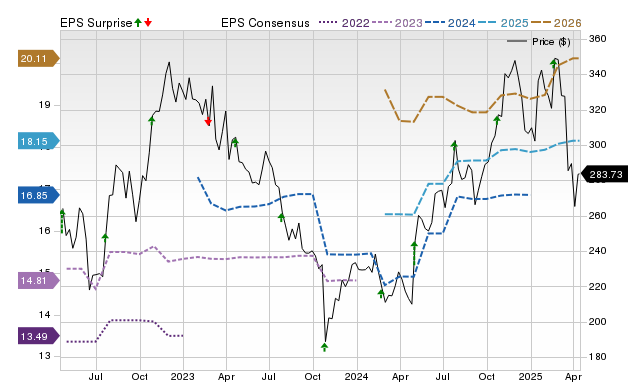

Selling price, Consensus and EPS Surprise

Earnings Whisper

Estimate revisions ahead of a company’s earnings launch offer clues to the small business conditions for the period of time whose benefits are coming out. Our proprietary surprise prediction model — the Zacks Earnings ESP (Anticipated Surprise Prediction) — has this insight at its core.

The Zacks Earnings ESP compares the Most Correct Estimate to the Zacks Consensus Estimate for the quarter the Most Correct Estimate is a more the latest version of the Zacks Consensus EPS estimate. The concept listed here is that analysts revising their estimates right in advance of an earnings release have the latest facts, which could most likely be more precise than what they and other folks contributing to the consensus had predicted before.

Consequently, a favourable or damaging Earnings ESP reading through theoretically indicates the probable deviation of the genuine earnings from the consensus estimate. Even so, the model’s predictive electricity is important for beneficial ESP readings only.

A favourable Earnings ESP is a strong predictor of an earnings beat, specially when combined with a Zacks Rank #1 (Solid Obtain), 2 (Buy) or 3 (Hold). Our study reveals that stocks with this mixture produce a constructive surprise just about 70% of the time, and a strong Zacks Rank actually will increase the predictive electrical power of Earnings ESP.

Please observe that a unfavorable Earnings ESP looking through is not indicative of an earnings miss out on. Our investigation exhibits that it is challenging to predict an earnings defeat with any diploma of self-assurance for stocks with unfavorable Earnings ESP readings and/or Zacks Rank of 4 (Market) or 5 (Sturdy Market).

How Have the Numbers Shaped Up for Valmont?

For Valmont, the Most Precise Estimate is the very same as the Zacks Consensus Estimate, suggesting that there are no recent analyst sights which vary from what have been thought of to derive the consensus estimate. This has resulted in an Earnings ESP of %.

On the other hand, the inventory at the moment carries a Zacks Rank of #3.

So, this mix tends to make it hard to conclusively predict that Valmont will conquer the consensus EPS estimate.

Does Earnings Surprise Record Keep Any Clue?

When calculating estimates for a company’s potential earnings, analysts usually take into consideration to what extent it has been able to match earlier consensus estimates. So, it really is really worth taking a seem at the shock background for gauging its affect on the upcoming variety.

For the previous described quarter, it was anticipated that Valmont would put up earnings of $2.12 for each share when it basically generated earnings of $2.57, providing a surprise of +21.23%.

Around the previous 4 quarters, the firm has overwhelmed consensus EPS estimates 4 times.

Base Line

An earnings beat or miss out on may perhaps not be the sole basis for a stock moving larger or reduced. A lot of shares stop up shedding ground regardless of an earnings conquer because of to other factors that disappoint traders. Likewise, unforeseen catalysts assist a selection of shares achieve even with an earnings skip.

That explained, betting on stocks that are anticipated to conquer earnings expectations does raise the odds of results. This is why it is really truly worth examining a firm’s Earnings ESP and Zacks Rank ahead of its quarterly release. Make confident to make use of our Earnings ESP Filter to uncover the greatest stocks to get or market in advance of they’ve documented.

Valmont would not look a persuasive earnings-beat applicant. Nevertheless, investors should spend interest to other elements much too for betting on this stock or keeping away from it forward of its earnings launch.

Infrastructure Stock Growth to Sweep The usa

A substantial drive to rebuild the crumbling U.S. infrastructure will quickly be underway. It’s bipartisan, urgent, and inescapable. Trillions will be put in. Fortunes will be created.

The only dilemma is “Will you get into the appropriate stocks early when their growth possible is biggest?”

Zacks has launched a Special Report to assistance you do just that, and now it is totally free. Uncover 7 unique corporations that glance to acquire the most from construction and restore to streets, bridges, and structures, in addition cargo hauling and power transformation on an almost unimaginable scale.

Obtain Free: How to Gain from Trillions on Spending for Infrastructure >>

Simply click to get this free report

Valmont Industries, Inc. (VMI): Cost-free Stock Examination Report

To study this post on Zacks.com simply click below.

The views and views expressed herein are the sights and opinions of the writer and do not automatically replicate people of Nasdaq, Inc.