Warning Flags For Home Construction

[ad_1]

Vertigo3d/E+ through Getty Photographs

By Robert Hughes

Full housing starts off fell to a 1.724 million annual level in April from a 1.728 million tempo in March, a .2 percent reduce. From a 12 months ago, full begins are up 14.6 %. Full housing permits also fell in April, posting a 3.2 percent fall to 1.819 million vs . 1.879 million in March. Complete permits are up 3.1 percent from the April 2021 degree.

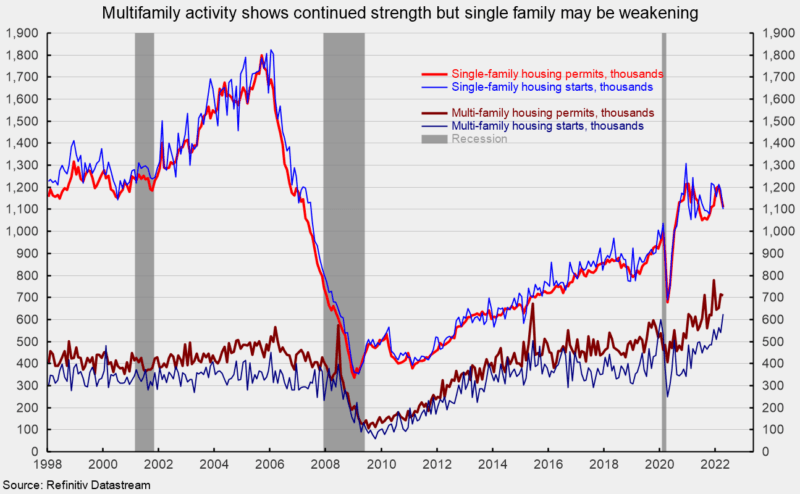

Commences in the dominant single-loved ones section posted a charge of 1.100 million in April versus 1.187 million in March, a drop of 7.3 percent but are still up 3.7 per cent from a calendar year back (see to start with chart). Solitary-spouse and children permits fell 4.6 % to 1.110 million vs . 1.163 million in March (see initially chart).

Commences of multifamily buildings with 5 or a lot more units enhanced 16.8 percent to 612,000 and are up 42.3 p.c over the past calendar year when begins for the two- to four-spouse and children-unit phase fell 29.4 percent to a 12,000-unit pace versus 17,000 in March. Put together, multifamily commences had been up 15.3 % to 624,000 in April and demonstrate a get of 40.5 % from a year ago (see to start with chart).

Multifamily permits for the 5-or-much more group fell .6 % to 656,000 although permits for the two-to-4-device classification diminished 5.4 p.c to 53,000. Put together, multifamily permits were 709,000, off 1. % for the thirty day period but up 15.7 % from a calendar year in the past (see very first chart).

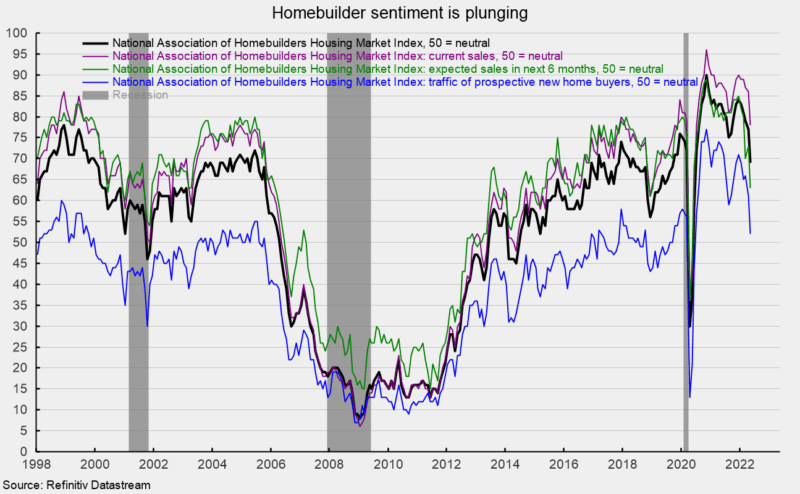

In the meantime, the Countrywide Affiliation of Property Builders’ Housing Industry Index, a measure of homebuilder sentiment, fell once more in April, coming in at 69 versus 79 in April, and down sharply from the latest highs of 84 in December 2021 and 90 in November 2020. Increasing mortgage loan rates, elevated house price ranges, and better enter costs are major problems (see next chart).

All three components of the Housing Marketplace Index fell sharply in April. The expected one-family sales index dropped to 63 from 73 in the prior thirty day period, the current single-spouse and children sales index was down to 78 from 86 in April, and the visitors of potential potential buyers index fell to 52 from 61 in the prior month (see next chart).

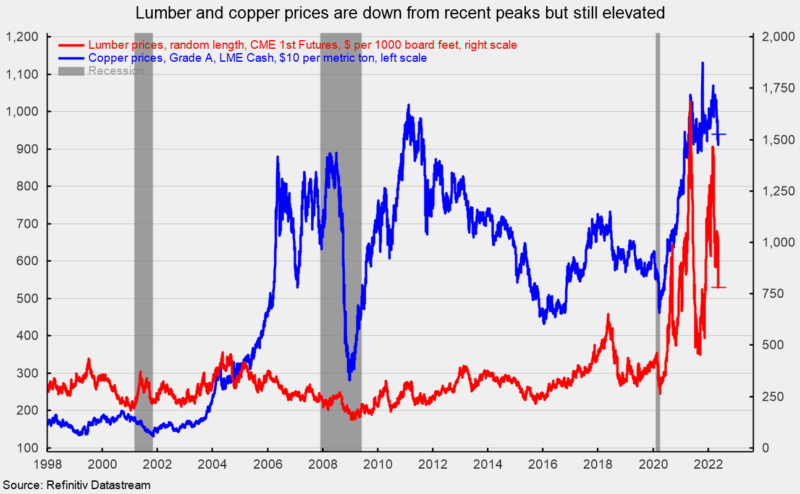

Enter charges are a problem for builders. Crucial input resources fees are down from peaks but however elevated with lumber coming in at around $780 for each 1,000 board toes in mid-May, down from peaks all around $1,700 in Might 2021 and $1,500 in early March 2022 although copper was down a little bit at $9,400 for each metric ton (see third chart). The substantial enter prices will strain revenue at builders and might direct to additional price tag raises for new households (see fourth chart).

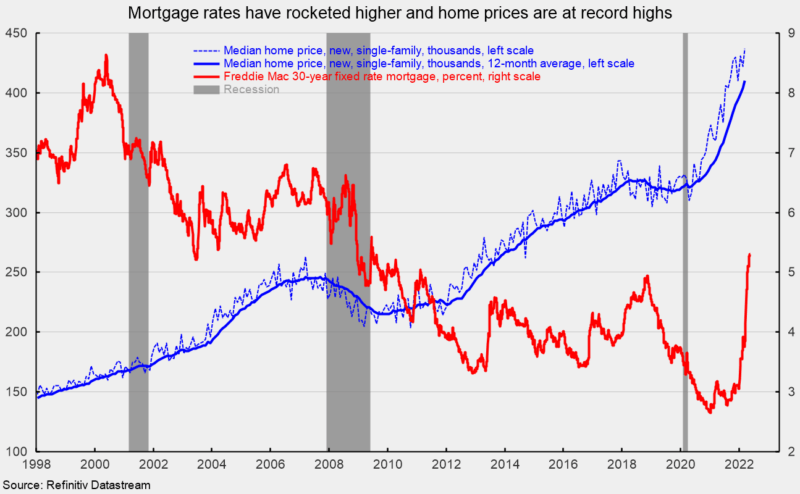

Moreover, property finance loan rates have rocketed bigger lately, with the fee on a 30-year fixed level mortgage coming in at 5.30 p.c in mid-May well, virtually double the lows in early 2021 though property price ranges are at report-large stages (see fourth chart). Greater household costs and greater home finance loan charges are probably to be significant headwinds for long run housing exercise.

Even though the implementation of everlasting distant operating arrangements for some staff members might be giving continued aid for housing demand, document-high house rates put together with the surge in mortgage loan fees will probably perform to amazing exercise in coming months. Threats to upcoming desire mixed with elevated enter expenses are sending homebuilder sentiment plunging. The outlook for housing, primarily the solitary-relatives section, is deteriorating promptly.

Editor’s Notice: The summary bullets for this posting have been decided on by Searching for Alpha editors.

[ad_2]

Source url