SIF Folio: Ought to I Purchase Renew Holdings?

This 7 days I’m turning to a company that’s crossed my radar in the past, but not manufactured it into the SIF portfolio. Renew Holdings (LON:RNWH) is a mid cap construction and engineering group.

I’d normally be sceptical about this sort of stocks, as many have a record of minimal margins and periodic mishaps. But Renew operates in five expert sectors, with a large bias in direction of vital infrastructure and controlled markets:

-

Rail – a extensive selection of essential maintenance providers

-

Infrastructure – mobile telecoms and road community

-

Energy – primarily nuclear

-

Environmental – drinking water infrastructure, flood alleviation and coastal defence.

-

Professional setting up – an odd combine, like upmarket London residential refurbishments and scientific laboratories

It’s crystal clear that much of this enterprise is both of those critical and indirectly underwritten by the public sector. A selection of subscribers have earlier prompt to me that this company is significantly less cyclical and bigger excellent than a lot more generalist friends. Prolonged-expression shareholders have certainly accomplished nicely, as the inventory has 12-bagged due to the fact March 2009.

Renew comes in a whisker of passing all of my screening checks, so I’ve resolved to acquire a closer search at this small business this week.

Renew Holdings: a particular scenario?

Though design is frequently cyclical, Renew Holdings operates in sectors with defensive characteristics. Most of its things to do ongoing unabated very last calendar year, as they had been seen as necessary. One particular exception was the firm’s nuclear decommissioning get the job done, but this was simply delayed, not dropped.

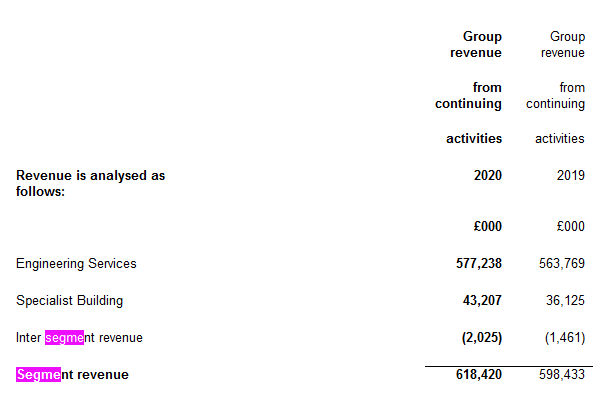

I’d like to know more about the income and revenue produced in different areas of the small business. However, Renew does not segment its income to replicate its five big running sectors. In its place, revenue and gains are split into just two segments, engineering services and specialist creating. This snapshot from the 2020 success displays that 93% of revenue came from engineering solutions final year:

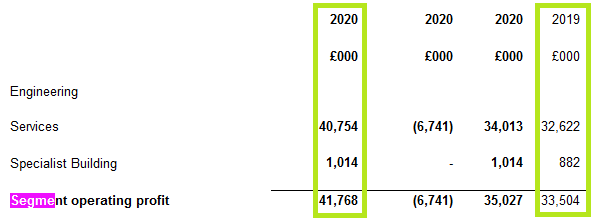

The revenue break up is even additional extraordinary. Past calendar year, 97% of functioning arrived from engineering companies. General performance in 2019 was comparable:

I could possibly obtain much more granular detail on income if I used time drilling into the accounts of the group’s working subsidiaries. Nevertheless, that degree of evaluation does not form section of the procedure I use for the SIF folio, so I’ll continue without this data.

For now, I’ll just function on the assumption that the…