Takung Artwork (TKAT) Vs Hall of Fame Resort & Entertainment (HOFV): Which Is A Greater NFT Inventory To Acquire?

NFT Shares Are Soaring As Electronic Asset Excitement Grows

Non-fungible tokens (NFT) are in just about every headline these times. And investors have been searching for NFT stocks to get in the stock sector these days. Takung Art Co. (NYSE: TKAT) and Corridor of Fame Resort & Entertainment (NASDAQ: HOFV) have began the week on a robust observe as portion of the speculative frenzy. Blockchain technologies has created it feasible for persons to personal exclusive digital goods. It could be artwork, new music, or movie saved on the blockchain, which is the electronic ledger technological innovation that powers cryptocurrencies like Bitcoin. Some NFTs have sold for hundreds of thousands and even thousands and thousands of dollars.

Institutional Investors’ & Celebrities’ Involvement Are Lighting The Fire For NFT Stocks

If you have been paying awareness to the inventory sector lately, you would know that this sort of speculative moves are not something new. But a person probable cause for the renewed interest this week would be Jack Dorsey advertising his initial-ever tweet today for a whopping $2.9 million. Dorsey, the CEO of Twitter (NYSE: TWTR) and Sq. (NYSE: SQ), is a huge advocate for cryptocurrencies.

Kim Forrest, main expenditure officer at Bokeh Cash Associates in Pittsburgh, said the desire in firms associated in digital property is “largely driven by the persons that feel they missed bitcoin”…“Obtaining the businesses presenting NFT would be like acquiring corporations that have some type of dealings with bitcoin in the early days”.

Of system, you could say a ton of the focus on NFT stocks is pure speculation. And that may possibly be right. Immediately after all, quite a few artists and famous people show up to be finding a piece of the action. Now, both of those Takung Artwork and Corridor of Fame Vacation resort & Amusement may well not be leaders in NFTs now. But their current companies could put them in a great position to mature into the blockchain area. Or at the very least, that is how the tale goes. Now, as each providers go on to make strides as we start out the week, which a single is a improved obtain correct now?

Study Far more

Takung Artwork Co. (TKAT)

Buyers really like Takung Artwork for the reason that of the company’s revolutionary business enterprise design. For those people unfamiliar, Takung has produced a market for shared possession in Asian good art. That has designed ownership of artwork available to more persons. But far more importantly, the company’s art business enterprise has been acquiring an too much to handle reaction as of late due to its possible NFTs participate in in this stylish market.

As you may well or may not know, a digital piece of artwork was not too long ago sold on the system for $69 million. Sure, you listened to that appropriate. One electronic piece of art just sold for a lifetime-modifying sum of dollars. That could assist reveal its explosive moves in the inventory market place. It also caught quite a few investors by surprise that TKAT inventory was only a penny stock previously this calendar year.

The company’s portfolio of Asia-distinct art is very good for its purchasers. Why? Which is only simply because the Chinese art marketplace is just one of the most quickly rising wonderful artwork industries in the environment. With practically anybody ready to bid on high-quality art, there is a high likelihood that this idea could have enormous interests amongst investors.

Why TKAT Stock Is An Interesting Speculative Participate in

The Takung portfolio is commonly varied. From paintings, calligraphy, jewellery to important stones, these are incredibly hot objects that have frequently been in big auction residences. The momentum we saw this 7 days is suggesting that a in the vicinity of-expression breakout in inventory cost is not one thing unattainable.

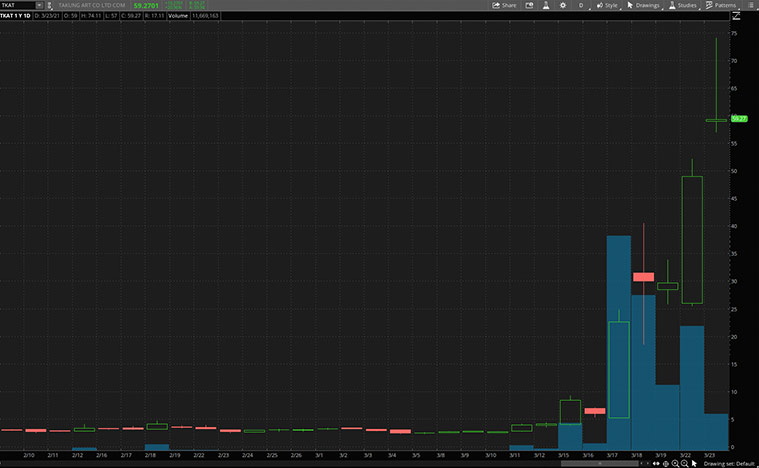

Resource: TD Ameritrade TOS

Resource: TD Ameritrade TOS

When investors are heading following shares tied to NFTs, the speculation is that Takung will launch an NFT system. Almost nothing is set in stone for the potential of TKAT inventory. Investors have to continue to keep in head that there’s a chance that the company will not formally shift into the NFT room. Of training course, if buyers are willing to pay out for these non-fungible tokens, it usually means they are really worth something. And must Takung make an official announcement that they are diving correct into the place, buyers could be in for a excellent ride.

[Read More] Top Cryptocurrencies To Acquire Now? 4 To Check out This Week

Corridor of Fame Resort & Leisure (HOFV)

Comparable to Takung Art, Corridor of Fame Vacation resort & Enjoyment (HOFV) stock skyrocketed yet again on Monday as it proceeds to experience on very last week’s momentum.

For people unfamiliar, HOFV inventory went community in the summer time of 2020 by means of a specific reason acquisition firm (SPAC) merger with the target of developing a Corridor of Fame desired destination for NFL enthusiasts. It intends to develop a sprawling entertainment intricate close to the Professional Football Hall of Fame in Ohio. Some refer to it as “Disneyland for soccer enthusiasts”.

The company’s stock rate soared amid a backdrop of a weak broader current market owing to mounting bond yields. Which is due to the fact rumor has it that HOFV could quickly make a go into NFTs. Some social media web-sites speculated that HOFV could be handling this method for the NFL. If that is the circumstance, it could be fulfilling certainly.

NFL-themed NFTs Are Receiving Investors All Fired up About HOFV Stock

The organization claimed on March 17 that the Nationwide Soccer League (NFL) is working on a system to enter the NFT industry. In accordance to the Sports Business Journal by Ben Fischer, the league at this time is engaged in ‘active conversations with likely associates to devise a strategy for electronic collectibles. To increase additional flavor to the discussion, the NFL is also looking into blockchain engineering for ticketing applications.

Supply: TD Ameritrade TOS

Supply: TD Ameritrade TOS

With all the excitement heading around cryptocurrencies, it is not shocking that lots of traders are speculating that the firm could be the NFL’s option in their NFT research. Should really the business progress with its intention of leaping into the NFT house, and if the NFL does opt for HOFV to head up its NFT initiative, it could be a massive chance for the organization and HOFV stockholders.

[Read More] Building A List Of The Very best Application Shares To Acquire? 4 To Take into consideration

Base Line On NFT Shares

As of currently, there’s no promise that both business could correctly include the NFT component in their operation. But the prospective is surely there. Buyers also have to observe that NFTs are nevertheless in their infancy. They will probably be very risky relocating ahead.

With the the latest operate-up in TKAT stock value, it’s regular to be anxious about the company’s valuation. Nevertheless, there’s no denying that fractionalizing fantastic art financial commitment making use of blockchain technologies could be a large breakthrough for the business. Due to the fact fine arts generally go up in price, incorporating NFT into its wonderful artwork company model could be a serious video game-changer for the company.

On the flip aspect, if you are into sports, you would value the digital collectibles of your favored sporting activities workforce. And if HOFV could properly strike a deal with the NFL, it would be a significant improve for the enterprise. Admittedly, the stories appear to be persuasive with HOFV stock and TKAT stock. But investors have to observe that there is a ton of speculation in this article. The NFT angle is by no suggests a sure thing. So if I were being to select just one now, I would require to acquire a deep breath ahead of generating any final decision.

The sights and views expressed herein are the views and views of the writer and do not automatically reflect people of Nasdaq, Inc.